When people don’t want to invest directly in stocks, they often choose mutual funds. Mutual funds use your money to invest in stocks, government securities, and corporate bonds. When these investments make a profit, it’s called “capital gains.” If you sell your mutual fund shares before 12 months, it’s called short-term capital gains. If you sell them after holding them for more than a year, it’s called long-term capital gains.

But a big question investors have is: Do you need to pay taxes on the money you make from mutual funds? The answer depends on how long you held your investment and how much profit you made.

How Are Mutual Funds Taxed?

In India, any mutual fund with more than 65% invested in Indian stocks is called an “equity fund.” The tax rate on equity funds depends on how long you held your investment.

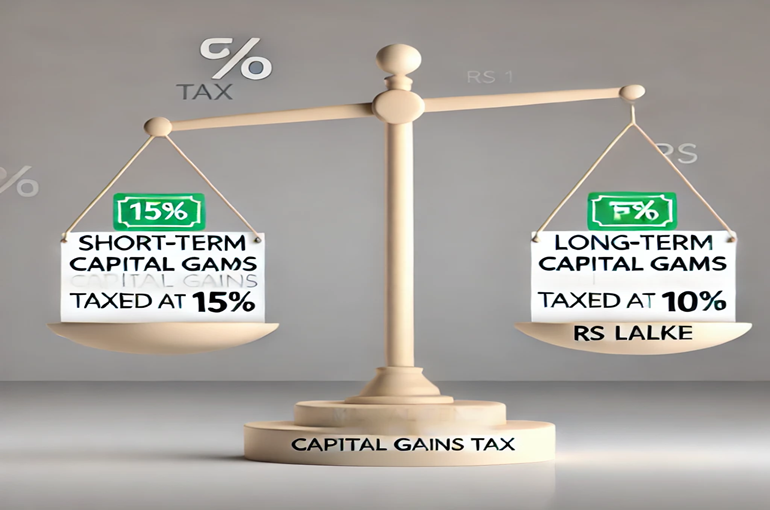

- Short-Term Capital Gains (STCG): If you sell your mutual fund within 12 months, you will be taxed at 15%.

- Long-Term Capital Gains (LTCG): If you sell after 12 months, you are taxed at 10%, but there is a benefit. You don’t have to pay taxes on the first Rs 1 lakh you earn from long-term capital gains each year.

Example: If you made Rs 2.5 lakh in long-term capital gains from your mutual fund, only Rs 1.5 lakh will be taxed. The first Rs 1 lakh is tax-free, so the tax on the remaining Rs 1.5 lakh will be Rs 15,000 (10% of Rs 1.5 lakh), plus extra charges like cess.

Balanced and Equity Savings Funds

Certain funds, like balanced funds and equity savings funds, may not invest a lot in stocks but still get taxed like equity funds. This is because they use special techniques to qualify as equity funds.

What About Debt Funds?

Debt funds used to have lower tax rates. However, since the 2023 budget, they are taxed based on your income tax bracket. This means if you are in a higher tax bracket, debt funds are not as good for tax savings.

Do I Need to Pay Taxes If I Have Losses?

If you lose money on your mutual fund investment, you don’t have to pay taxes on those losses. But there’s more to it. You can carry your losses forward to future years and use them to reduce the tax on any future gains.

- Long-term losses can reduce long-term gains.

- Short-term losses can reduce both long- and short-term gains.

This helps you save on taxes when you make profits in the future.

Conclusion:

When you invest in mutual funds, it’s important to understand how taxes work. Taxes on mutual funds depend on the type of fund and how long you hold your investment. If you make long-term capital gains, there is a tax benefit, and if you face losses, those can help reduce your taxes in the future. Be sure to understand the rules so you can manage your investments in a tax-efficient way.

FAQs:

Q1: What is the tax rate for short-term gains on mutual funds?

A1: Short-term capital gains from equity mutual funds are taxed at 15% if you sell them within 12 months of buying.

Q2: How much tax do I pay on long-term gains from mutual funds?

A2: Long-term gains are taxed at 10% if you sell after 12 months, but you don’t have to pay tax on the first Rs 1 lakh of gains each year.

Q3: Can I carry forward losses on mutual funds?

A3: Yes, if you make a loss on your mutual fund investments, you can carry the loss forward to future years and use it to reduce taxes on future gains.

Q4: Are debt funds taxed differently?

A4: Yes, debt funds are taxed according to your income tax rate, which can make them less attractive for those in higher tax brackets.

Q5: Do I have to pay taxes if my mutual fund investment loses money?

A5: No, if you suffer losses, you don’t have to pay taxes. You can also use these losses to reduce your future taxable gains.